Please review answers to common questions below.

General Questions

What does Videoquant do?

Videoquant (VQ) is like Bloomberg data for TV/video ad creative strategy.

We save brands major cash & time by helping them avoid TV & video creative strategies already known not to work. We do this by providing robust data insights from over 106,000,000+ TV ad & video outcomes for pre-production & production decision-making.

Here is how customers use us:

- Creative brief development / staple-on addendum

- Transitioning a creative brief to early concepts

- As a heavy-duty quantitative addition alongside or as a replacement to surveys, focus groups, and panel studies.

- Concepting (which gender to use for talent, what should be in background)

- Tweaking of concepts (i.e. – what color does the video outcomes data suggest works best for this product?)

- Final check before media spend.

- ACR / Postlog / iSpot Interpretation (we’re experts on this data)

TV commercials, Super Bowl ads, & paid video: Does Videoquant work?

Yes. Videoquant originated from the founder’s frustrations overseeing optimization of $100M+/yr in TV spent across 10 countries. It was developed for TV, but happens to work well for online video as well.

A Super Bowl license is specifically required for Super Bowl advertisements.

Does Videoquant work for social video (YouTube, TikTok, etc.)

Yes. In fact, our first test was conducted on a 1.4M-subscriber YouTube channel for a food influencer, where we delivered the video concept that remained the channel’s best-performing video by views for over a year.

What’s the secret sauce?

Utilizing a patent-pending ‘side-channel hack,’ we monitor internal video & TV performance data from top brands and channels. Our technique was developed by a team led by our founder—an ex-Wall Street quant and former Head of TV Data Science at a $2.6B MCap.

It’s akin to playing poker while being able to see everyone else’s hands. We then analyze this data on a massive scale to discern patterns that correlate with a higher or lower probability of success. Think of it as Sabermetrics for video marketing.

Where does Videoquant fit?

6 places.

Creative briefs are where we have the biggest impact; either as a staple-on addendum or research built into the brief. By infusing concrete, real-world video performance data into early guidance, we avert common creative strategy pitfalls that cause brands to struggle with anemic TV & video down the road.

Additional places we fit:

- Video Channel Feasibility: At this early stage, Videoquant provides valuable data-driven insights that help assess the potential success of using video as a marketing channel. These insights can shape your initial strategy and indicate whether the channel is likely to provide a reasonable ROI.

- Survey / Focus Group / Panel (substitute or augment): Videoquant can serve either as an enhanced replacement or as a quantitative supplement for surveys, panels, and focus groups. It can be utilized at various stages of the creative development process, enriching decision-making with robust data.

- Brainstorming: Videoquant fuels the brainstorming process by offering quantifiable patterns and success metrics derived from similar past campaigns. This allows teams to focus on creative ideas that are more likely to be effective, saving time and resources.

- Pre-Media Spend Screen / Test: Videoquant can act as a final quantitative test before allocating media spend on the finalized video creative, ensuring a data-driven approach to maximize ROI.

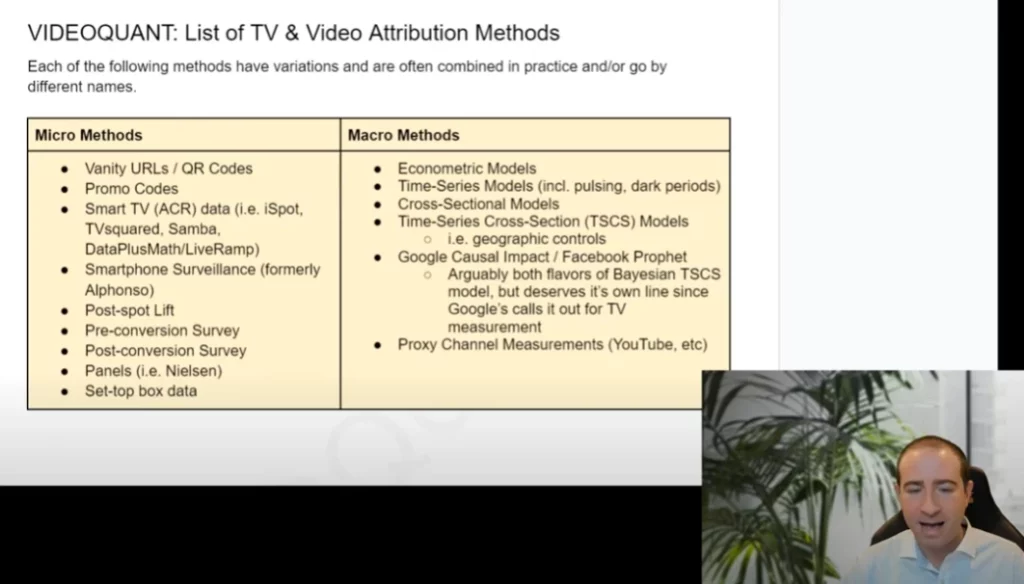

- Post-Media ACR/Postlog/iSpot Interpretation: We’re experts at this data, so while not part of our core offering, we often get asked questions about TV measurement and are happy to help.

Who’s on Videoquant’s team?

Members of our team include an array of world-class leadership in technology & video.

- The founder: an ex-Wall Street quant, ex-Head of TV Data Science (>$100M/yr video / 5 continents), founding member of the TV Performance Group – a Who’s Who of distinguished TV advertisers and video data scientists from Wayfair, Shark Ninja, Zillow, Vistaprint, Glassdoor, and other world-class brands.

- Tripadvisor’s co-founder and world-renowned ex-CEO of 22 years (advisor)

- ex-Global Head of Vistaprint / Grubhub / Drizly TV (advisor).

How Videoquant Compares

Why not surveys, focus groups, panel studies?

Because they don’t work great at foretelling how people will respond to video in practice; watch this 1984 Focus Group video to see the problem. Malcolm Gladwell’s book “Blink” explains why this failure happens.

In contrast, Videoquant uses real-world response data at enormous scale – over 1 Trillion human interactions across 10M+ TV & video assets. All from the comfort of one’s own living room or natural environment. This approach provides the most accurate glimpse into what video is effective and not.

Why not just A/B test?

The haystack is too large. Choosing what to A/B test out of the millions of possibilities is where significant error is introduced (assuming A/B testing of video is being done). Videoquant is basically narrowing the test space by ruling out stuff known not to work based on data.

Unlike SEM, SEO, and other marketing forms where thousands of tests can be run for near-zero cost and time, video is a complex medium. Tests are far more costly in terms of time and resources (you need to build the video), and there’s too much to test. We’ve quantified this problem: video has an 1800x higher cost-to-learn compared to SEM.

As an example, Videoquant can even estimate the value that specific top-tier actors and actresses would have if introduced to your specific specific ad concept. To A/B test that, you’d need to hire all the actors & actresses, build video with each, then A/B test.

What about tools that detect what parts of my video work?

Out of the near-infinite possibilities, this would require that you built the right video test in the first place. This is where most error gets introduced.

Further, the number of tests required to attribute lift to components of video aside from superficial tweaks (i.e. what if I change this color) exceeds most brands video marketing even if you were going in the right direction to start.

Our hack is we use other people’s money to figure this out. There’s no need for every brand to reinvent the wheel and spend $2B/yr.

As an example, Videoquant can even estimate the value that specific top-tier actors and actresses would have if introduced to your specific specific ad concept. To A/B test that, you’d need to hire all the actors & actresses, build video with each, then A/B test.

Why not GPT? (Hint: we use it heavily, but not how you think)

We have filed multiple patent applications for leveraging generative AI in video and TV advertising.

Publicly available GPT models don’t have knowledge about video engagement and downstream performance. In fact, we’ve found that GPT is more likely to produce poor-performing material for video content. This is because GPT is trained to generate the most logical next text based on its most commonly seen training data. Since most video content fails, and GPT outputs what it has seen most often, it tends to produce content that is likely to underperform.

By using VQ data, GPT can be fine-tuned to output content that is more likely to succeed as a starting point for video content. We also use GPT as a thin layer at both an early and a late stage in our process.

What about Dynamic Creative Optimization (DCO)?

Dynamic Creative Optimization (DCO) is like adjusting the sails on a boat, whereas Videoquant optimizes the blueprint of the vessel itself.

DCO specializes in tweaking minor creative elements in real-time, depending on viewer data.

In contrast, Videoquant helps develop the core foundation of impactful video content. It forecasts high-potential video concepts and messaging even before they’re crafted, drawing from performance & brand testing insights from millions of TV commercials and videos. By identifying patterns of success and failure, it ensures that the foundational video content starts robustly. While DCO hones in on momentary tweaks, Videoquant fortifies the core message, ensuring lasting impact and resonance.

The Videoquant method was designed with user privacy in mind. In contrast, DCO’s viability is uncertain as its effectiveness hinges on comprehensive real-time user data — data that’s increasingly restricted due to growing privacy concerns. With mounting regulations like GDPR and CCPA, coupled with moves by giants like Apple and Google to curtail tracking, DCO’s future is uncertain. Videoquant remains unaffected by these privacy shifts.

To sum it up, while DCO seeks to optimize delivery amidst diminishing data access, Videoquant anchors content with a foundation that amplifies its chances of success.

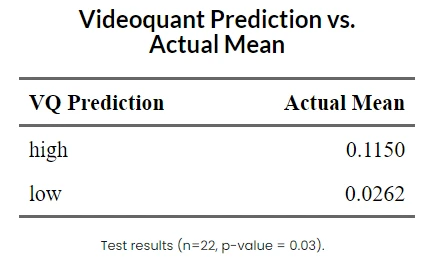

How Does Videoquant compare to Kantar or Ipsos?

For a brand using traditional market research tools that include both Kantar & Ipsos, VQ high predictions yielded 4.4x more incremental downstream lift in a blind case study (p-value 0.03). This translates to ~$2.4M savings per $10M media.

Why does Videoquant beat traditional research? Malcolm Gladwell’s book “Blink” explains why traditional research methods often struggle on TV & video. Unlike tools that rely on focus groups and surveys “behind-the-scenes,” none of which are great at foretelling real-world TV results, Videoquant is a new statistical-GPT technique that uses real-world TV & video data to understand how your target audience responds to video stimuli at massive scale (over 10 Million TV ads & videos).

Watch How This Traditional Method Fails For TV

But Videoquant’s power goes beyond red-flagging issues with traditional market research output. Videoquant can score just about any new TV or video strategy and put statistical confidence bands around its likelihood of success. It can then tell you how to modify the strategy to yield higher response. In cases where an existing creative strategy can’t be made viable for TV, it will suggest alternative strategies more likely to work for your goal & audience.

Put bluntly, Videoquant blows traditional TV research approaches like those of Kantar and Ipsos out of the water. It would mathematically be very difficult to beat Videoquant.

What about iSpot, Comscore, and Nielsen TV Measurement?

These are complementary to Videoquant; VQ is not a replacement for these. In fact, we sometimes introduce iSpot to VQ users.

Tools like iSpot help brands measure TV media performance after production investments and media spend has been incurred. But the challenge is determining what to test out of the infinite possibilities in video; brands burn out their budgets trying to A/B test their way to success. That’s where VQ comes in. VQ uniquely provides pre-production quantitative performance guidance on the video concept itself whereas iSpot and the like are post-production media measurement tools. These are entirely different and complementary technologies. I personally use both.

The other major difference is that while tools like iSpot can tell a brand that TV creative A worked better than TV creative B, they can’t say why since that requires entirely different data and technology that falls within VQ’s purview.

How does Videoquant compare to tools like VidMob or TubeScience?

Tools like these and others operate closer to the realm of DCO (Dynamic Creative Optimization) as previously explored. In contrast, Videoquant distinctively positions itself by 1) offering core foundational messaging optimization, 2) backed by real-world Fortune 500 controlled test validation and 3) our unparalleled leadership expertise. Our unique, patent-pending methodology has undergone rigorous evaluations within the Fortune 500 ecosystem, resulting in a degree of statistical reliability unparalleled by other platforms. The visionary behind Videoquant is an ex-Wall Street quant and a pivotal figure in the inception of the TV Performance Group, which comprises esteemed TV advertisers and video data scientists from globally renowned brands such as Wayfair, Shark Ninja, Zillow, Vistaprint, Glassdoor, and many more.

While DCO-type platforms purport to analyze video attributes for performance metrics, most tools with such assertions often fall short. This shortfall usually stems from their inability to access a vast reservoir of proprietary brand data essential for potent statistical insights. In contrast, Videoquant taps into its exclusive database brimming with performance metrics & brand tests from millions of TV commercials and video content. This affords us the statistical prowess to discern between effective and ineffective video strategies.

Our unmatched edge is further augmented by a cadre of elite professionals, such as the founder of Tripadvisor, and our specialization in machine learning, data science, and media acumen. With our team’s cumulative decades of experience, we delve deep into the intricacies of video content efficacy, unwavering in our dedication to ensuring your brand’s triumph.

Does my working with Videoquant benefit competitors?

Videoquant is like Bloomberg data for TV/video creative strategy (founder is an ex-Bloomberg Quant, so no surprise).

The data we license is exclusively sourced by Videoquant; we do not use or share data provided by users. Further, any custom reports and analyses built for/by users using Videoquant data are confidential.

Like Bloomberg, Videoquant doesn’t offer exclusivity, aligning with our mission to integrate robust data into TV/video creative strategy for the betterment of the trade. And like Bloomberg, the strength of Videoquant data lies in its capacity to unlock limitless strategic possibilities; no two brands will ever utilize our data identically. The power of Videoquant lies in its adaptability to enhance any creative direction. Like the thousands of directly competing asset managers with billions under management using Bloomberg, VQ users each craft their unique strategies. While the data exposes trends and opportunities, the magic lies in the confidential way each brand interprets and executes them, drilling down in their unique way.

Ironically, today’s video strategy landscape mirrors the world of quant finance in the 60s and 70s – reliant on surveys, polling, and intuition in an attempt to infer good direction. Bloomberg flipped this model on its head starting in 1981 with the vision of aggregating complex data to understand financial markets. We’re doing the same for TV/video. Like Bloomberg, VQ insights will become indispensable. Without it, brands will fall behind, repeating costly mistakes that others have made and that we can foresee and avoid.

Technical Questions

Are Videoquant results time sensitive?

Yes in most cases.

Time & season are an important component of video content within many industries. You may notice that results change when you re-analyze a topic. This is normal. In fact, we recommend refreshing results from time-to-time for previous reports you’ve ran.

Videoquant uncovered trending concepts predicted to perform poorly. How is that?

What’s trending and what’s likely to perform well for ROI & engagement are quite different.

VidTrend focuses on identifying what’s currently popular and trending in the world of video content. It looks at a variety of factors to determine what’s grabbing people’s attention in the moment. This gives a snapshot of current interests and tastes.

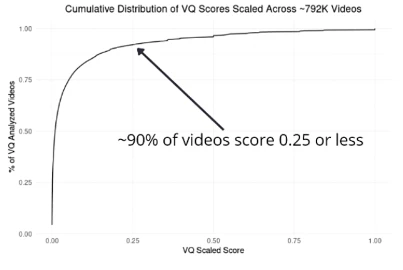

On the other hand, VidScore uses Videoquant’s proprietary video performance database and AI methodology to predict the potential success of video content based on historical data and patterns. It considers factors beyond just current popularity, such as audience retention, emotional engagement, and potential for conversion. So, while a concept might be trending, it doesn’t necessarily mean it will have a good ROI or drive meaningful engagement in the long run.

In essence, VidTrend gives you a glimpse of what’s hot right now, whereas VidScore provides insight into the lasting value and impact of a concept.

Ideally, we like looking for trending concepts that have high predicted performance. When there is disagreement, we advocate for VidScore taking precedent since it’s designed to predict downstream performance results.

Additional Questions?

Please contact us.