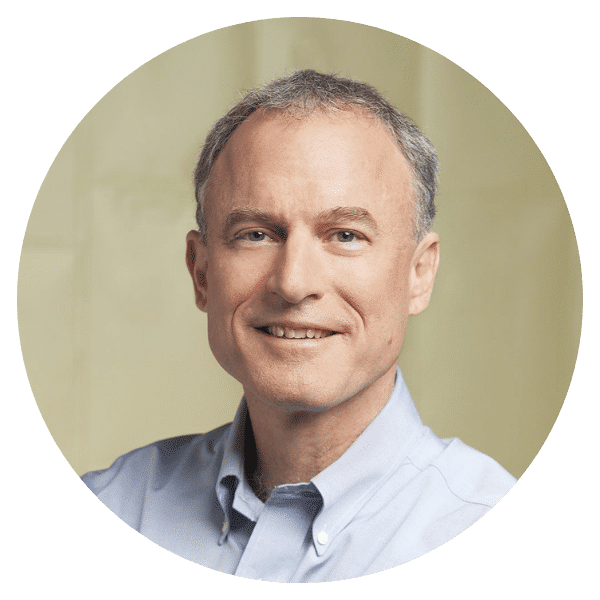

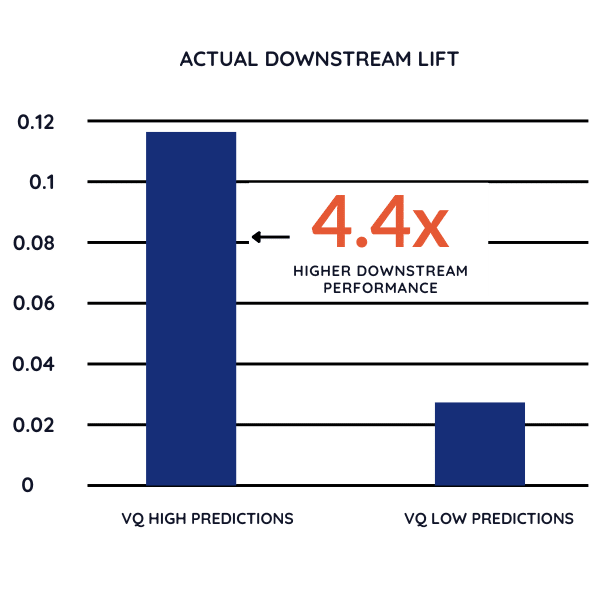

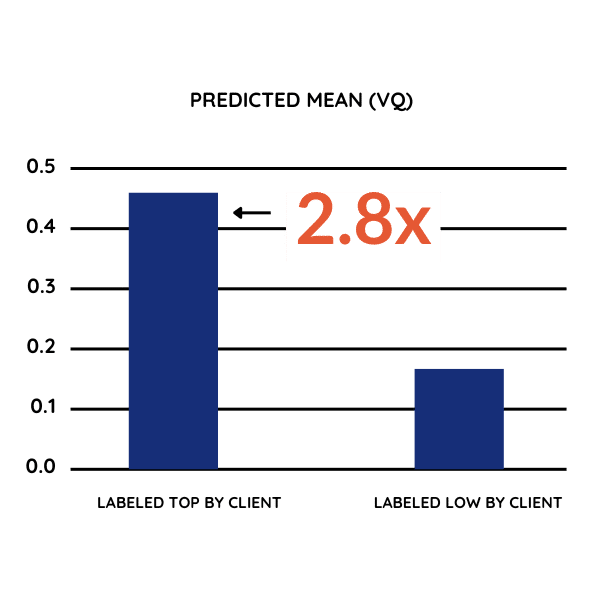

"I managed $100M+/yr in global TV. A scrappier competitor got 2x our results on the same media — better creative, not bigger budget. That cost me $40M+. Videoquant was built to fix that."— Tim D'Auria, ex-Bloomberg Quant, former TripAdvisor Head of TV Optimization