What is creative costing your media?

~70¢ of every ad dollar is driven by creative. Flag opportunities in 20 seconds—pre-spend.

Used by Super Bowl advertisers to lower CAC by up to 70%

Validated by category leaders including DraftKings and Uber

Transparent, published, and protected by U.S. Patent No. 12,020,279

How Much Value Can Creative Unlock?

If Finance asked where $0 of flexibility could come from, what would you change?

Videoquant is a patented AI creative optimization platform that pressure-tests creative before you spend, in 20 seconds, using outcome data from 200M+ people — not opinion surveys.

Makes creative a ROI & brand lift lever like never before possible.

Traditional Testing

Be 1,000 tests ahead, lifted creative results, and have spent less

while your competition is still fiddling with their first survey.

How It Works

No surveys. No focus groups. No A/B costs and waiting days or weeks for a costly wrong answer.

It's an extensive platform. In a nutshell, test ads or ideas against a real audience and get instant, actionable guidance - from briefs to scripts to final cuts. Launched on TV/CTV, now supporting paid social and more.

Input Ads (Competitors or Your Own)

Input ads, CTAs, or visuals you want to test.

Select Audience

Select the audience you want to test against.

Get Your Answer

Instantly see how the ad performs on the target audience.

Optimize

Let the system guide you towards what your target audience really responds to (not just what they say they want).

Reason for Videoquant

How Super Bowl brands like DraftKings & Uber win with Videoquant

76% of ads don't breakeven for 2 reasons. Opinion-based market research gets it wrong and A/B tests are slow & costly.

Super Bowl advertisers like DraftKings and Uber use Videoquant to move 100x faster at a fraction of the cost, replacing traditional market research & A/B testing.

Our client's controlled testing validated Videoquant boosted acquisitions by 3.6x on identical media spend.

Test My AdReason for Videoquant

Tripadvisor's founder explains

"Tim led Tripadvisor's TV advertising data science, optimizing $100M+/year in TV across 10 countries. With Videoquant, he developed a breakthrough approach and technology I wish we had back then—removing guesswork from advertising."

— Steve Kaufer, Tripadvisor Co-founder & ex-CEO of 22 years, CEO of GiveFreely

Check Your AdResults

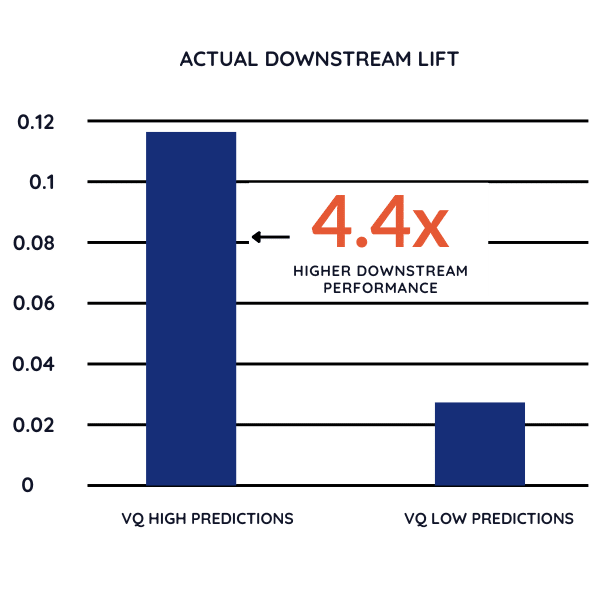

How Fortune 500 brands put Videoquant to the test

Blind study done by a $60B brand spending $2B/yr on marketing.

VQ predictions gave 4.4x higher brand lift & ROI (p-val 0.03).

$240K savings per $1M spent on TV.

Test My AdUse Cases

One platform. Endless applications. Videoquant powers 100x faster results across every corner of marketing.

Media & Channels

- TV & CTV — Proven in $1M+ of controlled TV tests, trusted in Super Bowl TV campaigns.

- OOH / DOOH — Billboards, transit, stadium signage, and digital out-of-home.

- Social & Display — TikTok, YouTube, Instagram, X, Snapchat, banners, programmatic.

Brand & Messaging

- Celebrity Valuation — Talent selection, negotiation leverage, and audience fit.

- Core Messaging — Positioning, taglines, value props, and CTAs.

- E-commerce / Catalogs — Thumbnails, titles, and product images that drive clicks.

Direct & CRM

- SEM / Paid Search — Headlines, copy, and extensions optimized before launch.

- Email, Direct Mail & CRM — Subject lines, CTAs, and formats tested for lift.

- Ad Exchanges — Creative-to-impression matching, yield maximization, and inventory optimization.

Every channel competes on creative effectiveness — not just media dollars. Videoquant gives you insight before you spend.

Reason for Videoquant

Why Billion-Dollar Brands Trust Videoquant

"Managing billion-dollar marketing budgets requires rigorous testing. Our tests confirmed Videoquant's predictions significantly correlated with crucial downstream metrics.

Videoquant's innovative approach leverages others' marketing investments to measure what works in the market before we spend."

— Michael Strickman, ex-Uber VP Performance Marketing and Growth

Check Your AdReason for Videoquant

What Took Months Now Takes Hours- And Is More Actionable

"Within 24 hours, Videoquant delivered us the equivalent of six months of focus groups and surveys—and it was based on real-world behavior rather than opinions.

It analyzed everything from our high-level strategy to granular tactics for our ads, including core messaging, scene selection, dialogue, and even how our talent should interact on screen. I was amazed by the speed of insights and actionability of results."

— Luke Tarbi, CMO of Peerspace

Check Your AdI'm Tim D'Auria, the Founder of Videoquant.

We've mastered avoiding ad fails by using computer vision, 18 Trillion human-marketing impressions, and custom audiences.

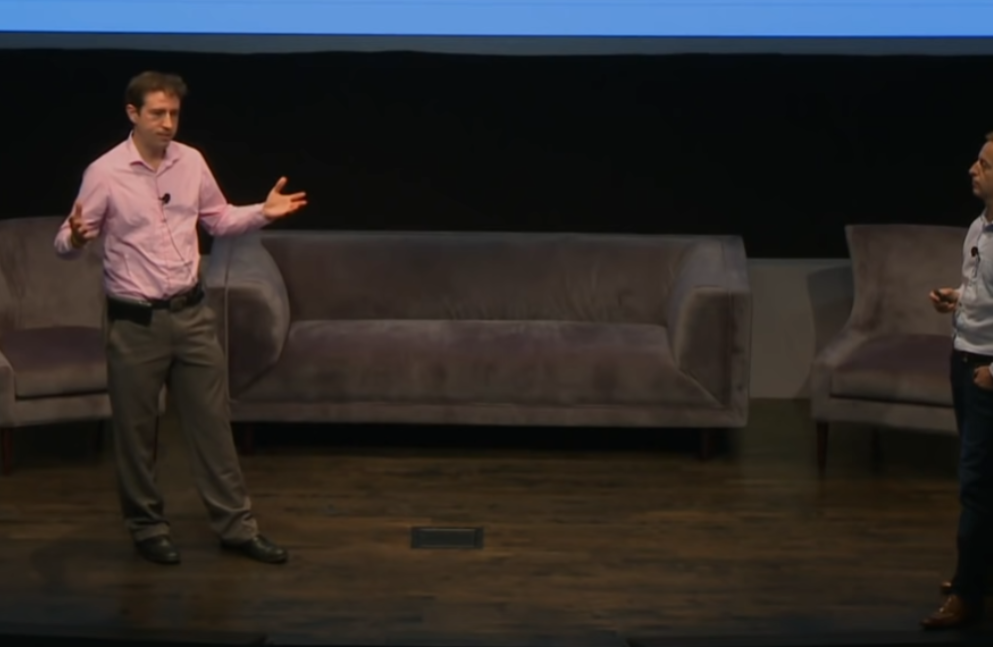

I'm an ex-Bloomberg Wall Street Quant, former Tripadvisor Head of TV Optimization, and can be seen in talks with the C-Suites of CBS, iSpot, etc.

See Tim speak with CEO of iSpot

More Results...

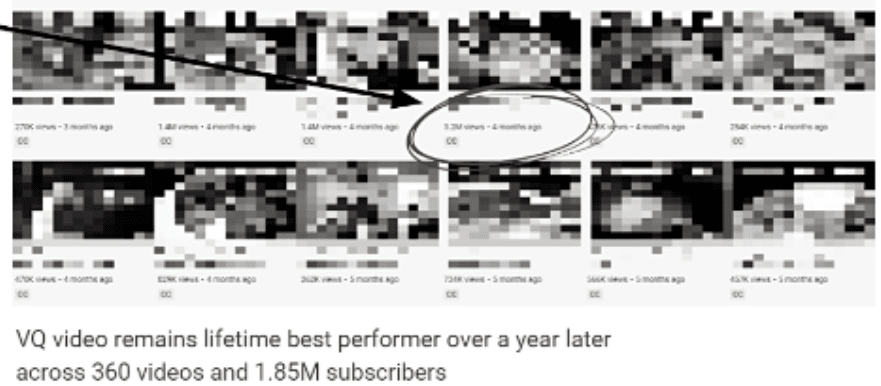

#1 Best Video for Over 1 Year. 1.4M Subscriber Channel.

1.4 Million subscriber YouTube channel.

VQ output a concept; the channel built it.

#1 most-viewed video for over a year across 360 videos.

Test My AdAdditional Data

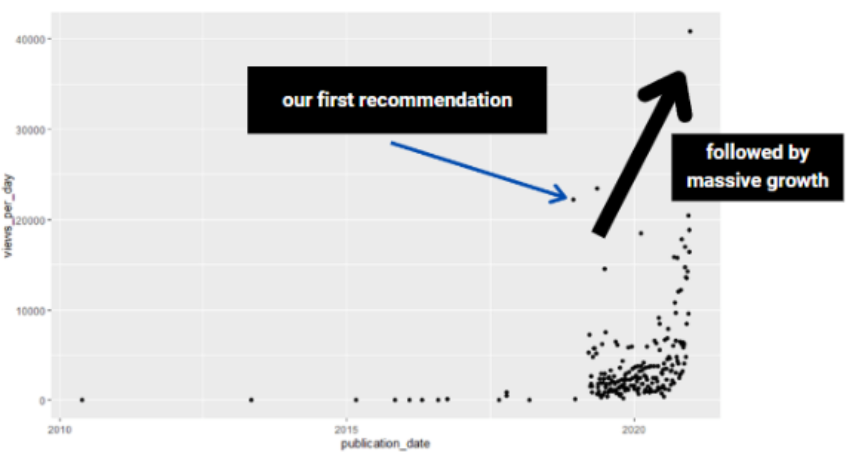

VQ Catapults Influencer

After building a VQ video concept, beyond the video becoming #1, the channel's views & subscribers took off.

Additional Data

Big TV Win!

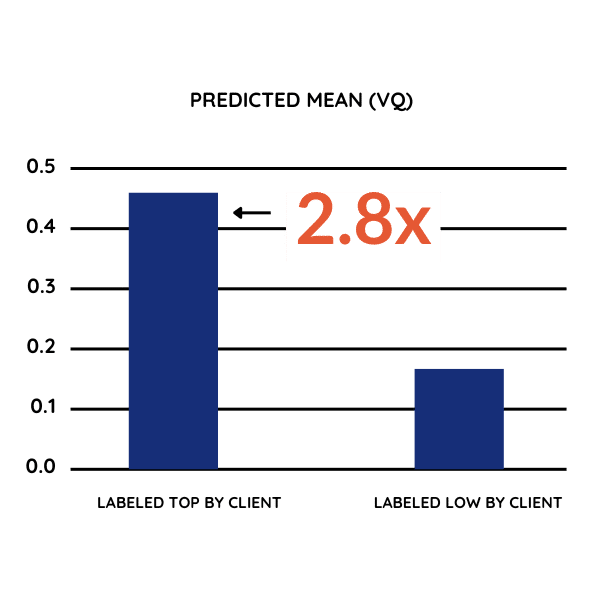

VQ predicted the probability that TV/video content would do well or not for the client. Media was run. Performance breakout between our high/low predictions emerged.

VQ made pre-media predictions

Brand ran media on video

VQ high predictions had higher downstream actuals.

Test My AdFounder with Industry Leaders

Videoquant is the 100x faster, more accurate AI replacement for market research & A/B tests.

Know Before You Invest